Blog

Stay up-to-date with FBMC related news & eventsCase Study: FBMC Saves A Georgia City $218K

Jun 1, 2023 | Case Study

The Situation A city in Georgia knew they had high cost claims issues, and budgeted for a 50% increase in November for...

Case Study: FBMC Saves A Florida School District $800K In Annual Rx Savings

Jun 1, 2023 | Case Study

The Situation A large Florida public school’s Pharmacy Benefit Manager (PBM) contract was up for renewal through a...

Employers are Hyper-Focused: The Top 3 Trends Moving into 2023

Dec 15, 2022 | Healthcare/Wellness

Employees and employers alike felt some level of discomfort in 2022. Though we are now two years past the onset of...

Physicians Health Benefits: A Benefits Solution For Providers – Risky Benefits Podcast: Season 3, Episode 13

Dec 8, 2022 | Podcast

PHB: A Benefits Solution For ProvidersOn mic is Fraser Cobbe, President of Cobbe Consulting & Management and...

How Employers Have Changed Their Benefits: COVID-19 in 2022

Oct 11, 2022 | Blog, Human Resources

Though whether or not we are truly ‘post-pandemic’ may be hotly debated, it is undeniable that COVID-19 has had a...

Put Your Benefits to Use: How to Drive Employee Plan Participation

Sep 12, 2022 | Blog, Human Resources

In the Great Resignation era, benefits have been key for companies looking to combat high levels of employee turnover...

Protect Workplace Culture – Risky Benefits Podcast: Season 3, Episode 11

Aug 22, 2022 | Podcast

Protect Workplace Culture 75% of people who have been harassed or discriminated against at work don’t report the...

Hooray Health – Risky Benefits Podcast: Season 3, Episode 10

Aug 4, 2022 | Podcast

To listen in and subscribe to more episodes, visit our website: fbmc.com/podcast. More About Our Guest: Shane Foss...

Healthcare Policy Update: The LTC Crisis – Risky Benefits Podcast: Season 3, Episode 9

Jun 28, 2022 | Podcast

This week on Risky Benefits, Trustmark Executive Director of Product Innovation, Adam Bezman, is on mic with Rick to...

Cracking the World of Sales – Risky Benefits Podcast: Season 3, Episode 8

Jun 13, 2022 | Podcast

Anneliese Finn, author of The Code, is on mic to talk to Rick about how to succeed in the world of sales as a woman....

Medefy: Better Benefits Navigation – Risky Benefits Podcast: Season 3, Episode 7

May 23, 2022 | Podcast

Meet Ashley Andrews, Sales Executive, with Medefy, a benefits navigation app. Medefy is an app to help you connect...

Education, Personalization & Automation: How 401(k) and Retirement Savings Plans Are Changing In 2022

Apr 15, 2022 | Blog, Human Resources

November 2021 saw a record 4.5 million people resign from their jobs. This mass exodus means prospective...

Technology Is Changing The Way Insurance Interfaces With Clients

Mar 22, 2022 | Blog, Healthcare/Wellness

Cropped shot of an attractive young woman hugging her grandmother before helping her with her finances on a laptop...

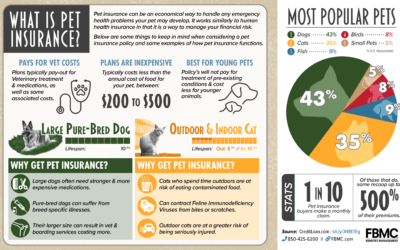

Pet Insurance Explained

Mar 1, 2022 | Blog

Making Sense of Covering Your Furry Friend with Pet Insurance Pet insurance can reimburse you for eligible veterinary...

The Great Resignation – Risky Benefits Podcast: Season 3, Episode 4

Mar 1, 2022 | Podcast

Megan Richardson, Vice President of Consulting at Dynamic Corporate Solutions, is on mic with Rick to talk about the...

Better Musculoskeletal Treatment for Everyone – Risky Benefits Podcast: Season 3, Episode 2

Feb 22, 2022 | Podcast

Mary O’Conner, MD, is on mic with Rick to talk about how musculoskeletal care delivery can improve with Vori Health....

Insurance Explained – Claims Adjuster

Feb 10, 2022 | Blog, Human Resources

Ever run into a situation when you need to use your insurance policy? Perhaps while you were on vacation last winter,...

How to Make the Hybrid Work Model Work for You

Jan 19, 2022 | Blog, Human Resources

The pandemic has resulted in thousands of employees working from their kitchen tables or living rooms rather than the...

OE is over! Or is it? Risky Benefits explores what’s next – Risky Benefits Podcast: Season 3, Episode 1

Jan 4, 2022 | Podcast

With the frantic race to open enrollment behind us, it’s time to catch your breath and reflect with Risky Benefits....

WellVia: Setting the Bar for Telehealth – Risky Benefits Podcast: Season 2, Episode 21

Dec 17, 2021 | Podcast

Care is in the details with WellVia teleheath. Experience a comprehensive telemedicine experience with the flexibility...

Flume Health: Market Differentiator – Risky Benefits Podcast: Season 2, Episode 22

Dec 17, 2021 | Podcast

Flume Health’s Chief Customer Officer, Kevin Schlotman, is on mic with Rick and Richard Koontz, FBMC’s Manager of...

Case Study: FBMC Reduces Annual Benefits Costs by $150K for a Midsized Business

Dec 16, 2021 | Case Study

A successful midsized business was looking for savings, service, and a better provider network in their self-funded...

How to Upgrade Your Wellness Program for 2022

Nov 16, 2021 | Blog, Healthcare/Wellness

With the COVID-19 pandemic, there’s been less of a need for in-person services and a bigger need for technology to...

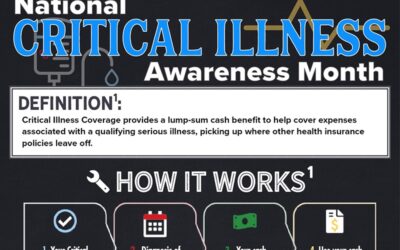

Critical Illness Insurance: Who needs it and how does it work?

Oct 20, 2021 | Healthcare/Wellness

October is Critical Illness Awareness Month Critical Illness insurance provides you with additional coverage for...

The Value of Voluntary Benefits

Sep 23, 2021 | Blog, Healthcare/Wellness

As health care costs continue to rise, so has the value of voluntary benefits. Voluntary benefits allow employers to...