News and Media

Stay up-to-date with FBMC related news & eventsFBMC Named to Top 100 Best Companies List

Press ReleaseContact Info:Vickie Chachere, Executive Editorvchachere@floridatrend.com FBMC Named to Top 100...

FBMC wins 2021 APEX Awards for “PowerON” video and corporate website design

FBMC Benefits Management, Inc. (FBMC), an industry leader in employee benefits, is excited to announce it has been named a 2020 APEX Award Winner for Insurance Website Design.

Featured in BenefitsPRO.com

Our article was just featured on BenefitsPRO.com, click to read...

Featured in BenefitsPRO.com

Our article was just featured on BenefitsPRO.com, click to read...

Just Published!

Check out our story just published in the Tallahassee Democrat's special section, the Chronicle.

FBMC Finds New Avenues to Spread Holiday Cheer

Press ReleaseContact Info: Nadia Mehriary 850-224-3175 nadia@themitchellsagency.com FBMC Finds New Avenues to...

FBMC services grow in Texas

Press Release Contact Info: Susan Ledford 850-425-6200 x3919 sledford@fbmc.com FBMC services grow in Texas...

FBMC Acquires DeMoss Financial’s Employee Benefits Division

Following their Annual Stockholder’s Meeting on June 1, FBMC Benefits Management, Inc. has announced the acquisition of DeMoss Financial’s Employee Benefits division.

FBMC Partners With INIE to Offer an Employee Benefit Service Program for Nonprofits

This program will help nonprofits to administer quality benefit programs and decrease their administrative burden.

FBMC wins APEX Award for website design

FBMC Benefits Management, Inc. (FBMC), an industry leader in employee benefits, is excited to announce it has been named a 2020 APEX Award Winner for Insurance Website Design.

Affordable Healthcare Benefits in Wake of COVID-19

Tallahassee, Fla. – May 2020 – FBMC Benefits Management, Inc. is teaming up with Zevo Benefits and...

FBMC donates to Tallahassee Memorial Healthcare Foundation

Tallahassee, Fla. – April 2020 – FBMC Benefits Management, Inc., a local benefits management company, is...

COVID-19 UPDATE AND FBMC BUSINESS CONTINUITY PLANS

FBMC Partners and Friends, For the past 44 years, FBMC has been focused on two primary objectives: creating a safe and...

CLIENT SATISFACTION IS ON THE RISE

Client Satisfaction is on the Rise at FBMC Benefits Management, Inc. Tallahassee, Fla. – February...

FBMC continues to provide support for panhandle families

A year after Hurricane Michael devastated the Florida Panhandle, many families are still struggling to recover. However, this Christmas will be brighter for seven children in Panama City thanks to help from FBMC Benefits Management, Inc.

FBMC Donates Back Packs and School Supplies to Sabal Palm Elementary

Tallahassee, Fla. – August 2019 FBMC Benefits Management, Inc., an employee benefits solutions company, raised nearly...

FBMC EARNS 2019 APEX AWARD FOR PUBLICATION EXCELLENCE

Tallahassee, Fla. – August 2019 – FBMC Benefits Management, Inc., an employee benefits solutions company,...

FBMC Welcomes new board member David Essary

Tallahassee, FL, May 2019 – FBMC Benefits Management, Inc. (FBMC) is excited to announce and...

FBMC regulatory officer co-writes article on ‘right to disconnect’

In an article published in the Association for Corporate Counsel’s ACC Docket on May 17, Patrick Flemming, FBMC Benefits Management Chief Regulatory Officer, and Linda Bond Edwards, Rumberger, Kirk & Caldwell Partner, discuss employees’ “right to disconnect,” and the proposed New York City bill aimed at improving work-life balance.

FBMC Board Member honored for community service

FBMC Benefits Management, Inc. is pleased to congratulate Anita Favors, FBMC board member, on her recent recognition as an honoree of the 2019 Annual Edwina Stephens Community Leaders Awards Banquet held by the Smith-Williams Service Center Foundation, Inc.

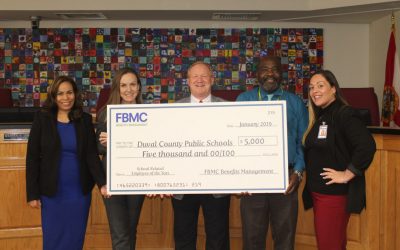

FBMC sponsors school district banquet

Tallahassee, Fla. – FBMC Benefits Management, Inc., is pleased to announce its sponsorship of Duval...

FBMC welcomes a new Chief Operating Officer

FBMC Benefits Management, Inc. (FBMC) is excited to announce and welcome Krista Campbell as its new Chief Operating Officer (COO). Campbell will be responsible for the Information Technology, Project Management, Data Security, Service Center, Benefits Administration, and Direct Bill departments.

FBMC HR Manager 2019 Big Bend SHRM chapter president

FBMC Human Resources Manager Monique Akanbi has been inducted to serve as the 2019 President of the Big Bend Chapter of the Society for Human Resource Management (SHRM).

FBMC employee among Most Influential Women In Benefits Advising

FBMC Benefits Management, Inc. (FBMC), an employee benefits industry leader, is pleased to announce that Vickie Whaley, Vice President of Sales and Service, has been named as one of Employee Benefits Adviser’s Most Influential Women in Benefit Advising for 2018.

FBMC & Hurricane Michael update

I wanted to give you an update on FBMC’s business continuation efforts. I’m sure you have seen the impact from hurricane Michael – it is devastating and our thoughts and prayers go out to everyone impacted. Tallahassee and the surrounding counties were significantly impacted, but everyone at FBMC is safe and we are thankful for that. Many of us are still without power and sustained property damage, but that can be repaired.